Unfortunately, how your credit score is calculated is similar to asking for the secret recipe for the Colonel’s fried chicken. In short, the people behind your credit score, The Fair Issac Corporation, aren’t going to let you in on their little secret. They guard this information to keep competitors at bay, knowing that if they reveal the exact credit score formula and let them to know what is the best same day cash loans website, how it works, they will lose their edge and jeopardize their dominant position in the marketplace.

What does this mean for you, the consumer? There are a few things you can and should know about your FICO score to increase your credit score and make yourself worthy of the credit you want.

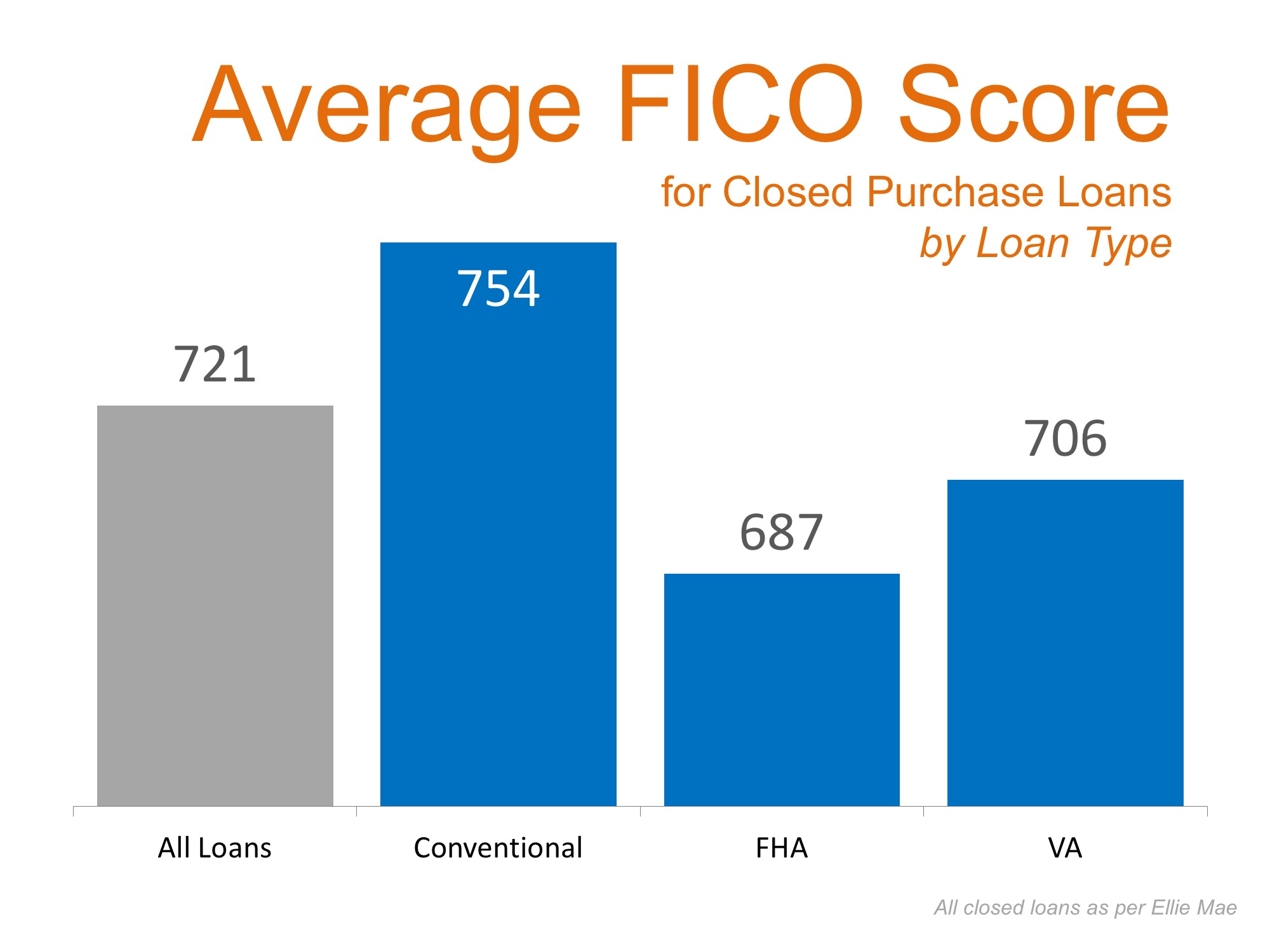

First of all, your FICO score will fall somewhere in the range of 300-850. As you may have guessed, the higher your credit score is on the range of scores, the better. Most lenders prefer that you have a credit score above 700.

Second, we know that FICO sets credit scores based on different types of consumers. For example, the formulas take into account the credit risk of a 21-year-old male with new credit versus a 73 year-old female with little credit. The credit risk is totally different and is part of the credit formula that FICO keeps under lock and key.

But, they have given us a benchmark of what details and how much weight they have in the final calculation of the FICO scoring formula. Instead of trying to steal the code, we should focus on the five factors that we can control. These five factors include:

Payment history – How you pay your bills makes up 35% of your FICO score. It goes without saying that paying your bills on time will have a positive impact on your credit score, while paying your bills late or not at all will have a dramatically negative impact. Even paying one bill late will cause your FICO score to take a hit, so make sure you’re paying your bills on time. If you’ve made mistakes in the past and haven’t always paid your bills on time, don’t fret. If you change your ways and pay on time, your FICO score will eventually reflect that. Late payments have less of an impact on your credit score once time has passed. For example, a late payment two years ago will matter less in your current FICO score than a late payment last month.

Debt to Income Ratio – The amount of debt you have versus the amount of money you earn makes up another 30% of your FICO score. Financial experts say that you debt-to-income ratio, or DTI shouldn’t exceed 36%. This means that your debt load should not be more than 36% of your monthly gross income. So, if you’re looking to improve your credit score, you should work on reducing your debt as much as possible.

Credit History – The length of your credit history makes up 15% of your overall FICO score. The credit score formula calculated by FICO wants to see that you have a history of using credit wisely, so it rewards this. That’s why older adults generally have higher credit scores than people in their twenties: they have had credit for a longer period of time and this factor weighs positively in their favor.

Credit Applications – The number of credit accounts you apply for has an impact on your credit score as well. This factor makes up 10% of your credit score. Why? Because applying for many credit cards at one time signals that you are trying to get access to a lot of credit that you may not be able to pay back. You will help improve your credit score by applying for credit only when it’s appropriate.

Types of Credit – The types of credit accounts you makes up the final 10% of your credit score. The FICO credit formula weighs your credit accounts differently. For instance, a revolving credit account is weighed differently than an installment loan like a mortgage. Having diverse credit accounts, while maintaining good payment histories, will help increase your credit score in the long run.

While it’s true that you don’t have complete control over your FICO score, you do have control on your actions. By maintaining a good payment history, keeping your DTI low and applying for credit sparingly, you’re on your way to a high FICO score.